How Founders Should Read Financial Statements for Better Decisions

Most founders receive financial statements every month. They glance at revenue, check profit, and move on. The reports feel technical, time consuming, and disconnected from daily decisions.

This is not because founders lack intelligence. It is because financial statements are rarely prepared with decision making in mind.

Understanding how to read financial statements properly can change how founders approach pricing, hiring, growth, and cash management. This is also where many founders realize the difference between having reports and actually using them.

Start With the Question, Not the Numbers

The biggest mistake founders make is opening a financial statement without a question in mind. Reports are not meant to be read line by line. They are meant to answer specific business questions.

Before looking at any statement, ask what decision you are trying to make. Are margins declining. Is cash tight. Can you afford to hire. Are returns increasing.

When financial statements are read with intent, they become far more useful.

How to Read the Profit and Loss Statement

Most founders focus only on the bottom line. This is rarely the most important number.

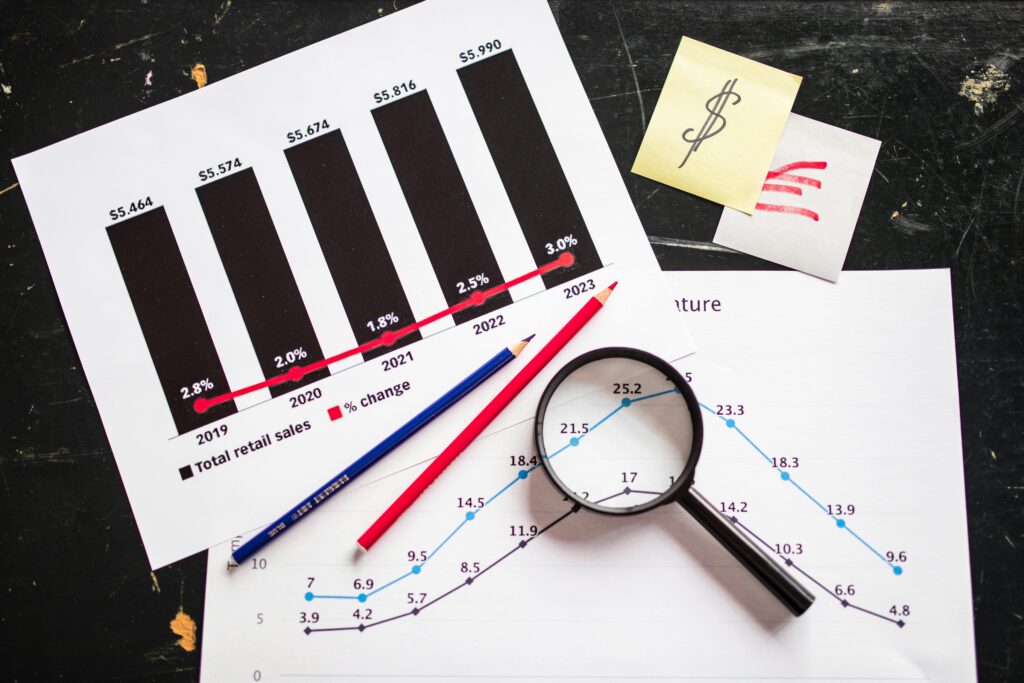

The real value of the profit and loss statement lies in understanding how revenue turns into profit. Gross margin shows pricing strength. Operating expenses reveal cost discipline. Trends over time tell a far stronger story than a single month.

For e commerce founders, this means paying attention to product margins, platform fees, and returns. For SaaS founders, it means understanding revenue quality, customer acquisition costs, and operating leverage.

A fractional CFO helps founders focus on the few lines that actually drive outcomes instead of drowning in detail.

Why the Balance Sheet Matters More Than You Think

Many founders ignore the balance sheet completely. This is a mistake.

The balance sheet explains cash, liabilities, and obligations that do not appear clearly in the profit and loss statement. Inventory, receivables, deferred revenue, and payables all live here.

In e commerce, inventory and payables often explain cash stress. In SaaS, deferred revenue and accrued costs shape runway reality.

Founders who understand the balance sheet stop being surprised by cash issues.

The Cash Flow Statement Connects Everything

If the profit and loss statement shows performance and the balance sheet shows position, the cash flow statement shows reality.

It explains why profit does not always turn into cash. It highlights timing issues and working capital movement.

Most founders only look at bank balances. A cash flow statement explains why those balances change.

This is where strong cash flow management begins.

Why Founders Still Struggle Despite Having Reports

Financial statements are usually prepared for compliance, not decision making. They are backward looking and generic.

Founders struggle because the reports do not answer operational questions. They show totals, not drivers.

Fractional CFO services exist to bridge this gap. The role focuses on reshaping financial statements into management tools rather than accounting outputs.

How Better Interpretation Leads to Better Decisions

Once founders learn how to read financial statements properly, decisions become calmer and more confident.

Pricing decisions become data driven. Hiring plans feel controlled. Growth feels planned instead of risky.

This shift does not come from more reports. It comes from better interpretation and context.

Final Thought

Financial statements are not meant to impress accountants. They are meant to help founders lead.

Learning how to read them correctly is one of the highest leverage skills a founder can develop. For growing businesses, this skill often comes faster with the support of experienced financial leadership.

If reports exist but clarity does not, the issue is rarely the numbers themselves. It is how they are being read and used.